Three Key Elements for Manufacturers to Ensure Successful Onshoring

Even before COVID-19, tariffs and trade wars wreaked havoc on supply chains for several years. But those who adapted their supply chains before COVID have fared better during COVID.

Now, more US manufacturers are rethinking offshoring. According to the 2020 State of Manufacturing Report, “73% of participants have minimized or plan to minimize reliance on China, and the US is the number one location for adding new suppliers, with Mexico and Malaysia not far behind.”

Let’s discuss three elements US manufacturers should employ to ensure successful onshoring.

Element One: Weigh Your Options

Manufacturers have a combination of reasons for onshoring and understand that they might lose market share in one area and gain in another. Manufacturers who successfully onshored some or all of their operations weighed the following:

• Inventory cost. According to a survey by international law firm, Foley & Lardner LLP, “62% of respondents agree (and 17% of those respondents strongly agree) that the pandemic will lessen companies’ focus on JIT manufacturing models that emphasize low costs and lean inventory.” While not all manufacturers have room to store more inventory at their location, many are sourcing new suppliers and requiring them to maintain a certain amount of materials.

• Supply risk. Foley & Lardner also found that 90 percent of manufacturers predict they’ll focus less on sourcing from the lowest-cost supplier and instead will emphasize a supplier’s ability to provide more resilient and flexible processes. More manufacturers are finding that supply risk is intolerable.

• Labor cost. Labor costs are rising offshore. Even in third-world countries, employees are demanding better pay and benefits, triggering higher prices for goods made abroad. Manufacturers are increasingly unlikely to find cheap labor overseas.

• Transportation cost. Rising fuel and other costs of transportation make it worth doing a cost comparison and considering sourcing suppliers that are closer to home.

• Quality. Poor quality of offshore goods results in expensive recalls, lower customer satisfaction and even injuries and deaths. Manufacturers who can claim their products are made in America could gain a competitive advantage over those who offshore. According to a Standard Textile infographic, 80 percent of American consumers prefer products with the “Made in USA” tag. And 62 percent of Americans associate “Made in the USA” with high quality. The bottom line is that three out of every five Americans will pay 10 percent more for products made in the US.

• Product timelines. Offshoring can add weeks to delivery time. Manufacturers who can’t get their product in times of demand risk losing market share.

• Tariffs. An unknown, highly politicized and volatile factor, tariffs can make offshoring unpredictably cost prohibitive.

• Innovation. As technology and automation improve production processes, manufacturers better manage the entire supply chain and make adjustments to mitigate disruptions.

Element Two: Rethink Your Contracts

Force majeure clauses have been standard in contracts between buyers and sellers, often without much thought given to what those terms really mean. They were often written as if the buyer and seller had the same motivations.

No more. Manufacturers now must consider everything that can go horribly wrong, including:

- Natural disasters, such as hurricanes, tornadoes, earthquakes, wildfires and floods.

- Human-driven complications, including riots, terrorism and labor strife.

- Plant/Facility problems, like fires, explosions, floods, power outages and machinery woes.

- Government actions, including wars, embargoes and tariffs.

- Diseases, everything from the ongoing COVID-19 pandemic to emerging public health threats.

A recent National Law Review article offers some timely advice for manufacturers:

- A seller will want to narrow force majeure events to matters that are truly outside of the seller’s control and buyer-friendly force majeure provisions might exclude strikes or anything involving the seller’s workforce.

- The buyer won’t want to include tariffs, government embargoes or acts of government among the enumerated events under a force majeure provision and include an additional protection in the pricing provision that prices are inclusive of “all costs, including taxes, imports, duties and tariffs.”

- Although it’s become standard practice for force majeure provisions to contain the broad, catch-all language at the end of a parade of horribles — “or any other circumstances beyond a party’s reasonable control which prevents performance ”— this might allow the seller to claim that anything not explicitly listed that prevents performance is a force majeure event.

- Buyers will want to require prompt notice of any force majeure event so they can immediately evaluate supply chain impacts and execute contingency plans.

- Buyers should ensure that there are “escape hatch” clauses so they can exit supply agreements if sellers can’t resume performance quickly. This should align with a buyer’s contingency plan to get support from alternate suppliers.

Element Three: Move Towards a Circular Economy

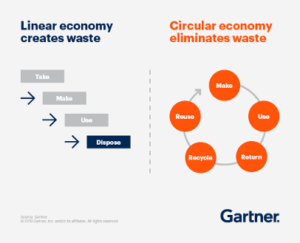

According to the business strategy consultancy Gartner, “by 2029, the circular economy will be the only economy, replacing wasteful linear economies.” In a linear economy, manufacturing follows the process of taking-making-using-disposing. A circular economy eliminates the waste by returning, recycling and reusing where possible. Not only does this eliminate supply chain risks, but it’s also good for the environment. Consider the case of Caterpillar. It takes back more than 150 million pounds of material from customers annually in order to remanufacture it.

According to the business strategy consultancy Gartner, “by 2029, the circular economy will be the only economy, replacing wasteful linear economies.” In a linear economy, manufacturing follows the process of taking-making-using-disposing. A circular economy eliminates the waste by returning, recycling and reusing where possible. Not only does this eliminate supply chain risks, but it’s also good for the environment. Consider the case of Caterpillar. It takes back more than 150 million pounds of material from customers annually in order to remanufacture it.

There are several other ways to build a circular economy, depending on your manufacturing operation. You might decide to refurbish and resell. Or repair or upgrade, or reuse parts. Examine this diagram

provided by Accenture to identify how you may be able to create a circular business model

Whether or not you are considering onshoring some or all of your manufacturing operations right away, these three elements are helpful to review on a regular basis so you have time to plan and implement new supply chain procedures.

Back